Episode 15: From Classroom to Certification: Andy Temte's Unique Perspective on Financial Modeling

In this episode, Paul Barnhurst is joined by Dr. Andy Temte.

Dr. Andrew Temte, CFA, is the former CEO of Kaplan Professional and author of “Balancing Act: Teach, Coach, Mentor, Inspire,” and "The Balanced Business: Building Organizational Trust and Accountability through Smooth Workflows." He is also a board member and senior advisor at the FMI.

A thought leader on financial education and issues related to organizational health, continuous improvement, and workforce re-skilling, his articles have appeared in a number of media outlets, including Chief Executive and Chief Learning Officer.

This blend of higher education and professional education experience gives Dr. Temte a unique perspective when it comes to financial education and financial modeling

Listen to this episode as Andy shares:

• His learning from the worst models he has come across.

• His experience reviewing financial models for acquisition targets

• His experience as a Member of the Board of FMI.

• The value of Financial Modeling Accreditation.

• Everything about his book ‘The Balancing Act’.

• His motivation to start a Podcast.

• His position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, AI in modeling, and more.

Special Episode: Run the Numbers by CJ Gustafson

This week, we are bringing you a unique episode. This week, we are sharing a podcast that our host, Paul Barnhurst, recommends. The Run the Numbers podcast is hosted by CJ Gustafson. The podcast is designed to talk about things he wishes he knew during the early days of his career that no amount of Googling would answer.

This week's Show Notes:

Sebastian Duesterhoeft, partner at Lightspeed Ventures, joins CJ to talk about anything and everything start-up operators need to know about your Total Addressable Market.

Episode 13: How Financial Modelers build a goldilocks “Just-right” Financial Model with Brian Egger

In this episode, Paul Barnhurst is joined by Brian Egger.

Brian is the Global Head of Financial Modeling, Senior Gaming/Lodging Analyst at Bloomberg Intelligence.

He has been publishing models professionally and writing investment research since the 90s on the sell-side as a brokerage analyst. His industry focus has always been broadly centered around consumer gaming, lodging, and leisure.

Brian has also worked in player-coach roles, whether it's being a research director or team leader or his current role, head of financial modeling, and outside the realm of being a practitioner, he has experience teaching as well.

Listen to this episode as Brian shares:

· His experience with finding the right balance as a Modeler.

· His learning from the worst models he has come across.

· His role as the Global Head of Financial Modeling at Bloomberg.

· Everything about Bloomberg’s Interactive Calculator.

· Trends of the Industry over the years.

· His thoughts on the FMI program and why continuous learning is so important.

· His position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, AI in modeling, and more.

Episode 12 - From Rocks to Riches: The Power of Financial Models in the Mining Industry with Emilie Williams

In this episode, Paul Barnhurst is joined by Emilie Williams.

Emilie holds a Bachelor of Engineering (B.Eng.) in Mining, a Masters degree in (M.A.Sc.), Civil Engineering, and has earned her Level I and II FMI modeling certifications.

She has been bridging the gap between mine engineers, operations, finance, and management for more than 15 years. She has real-world, industry experience working on mine project strategies, diagnosing, and solving for factors that lead to project delays and inefficiencies, and creating best-practice tools and models to help her clients manage their operations, costs and realize their objectives.

Listen to this episode as Emilie shares:

· Her journey from mine engineer to full-time financial modeler

· Her learnings from the worst models she has come across

· The unique challenges of modeling in the mining industry

· Her experience with competing in ESPN’s most recent Excel Battle

· The importance of practicing to be a better Modeler

· Her position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, AI in modeling, and more

Special Episode: Breaking into Finance Podcast with Craig Thompson

This week we are bringing you a unique episode. This episode is a Breaking Into Finance podcast episode hosted by Craig Thompson featuring Paul Barnhurst.

Show Notes from Breaking Into Finance

Last episode we teed up the topic of exit opportunities and the types of careers paths available to finance professionals. Today we're excited to be joined by Paul Barnhurst AKA The FP&A Guy, host of FP&A Today and Financial Modeler's Corner. Financial Planning & Analysis ("FP&A") drives the strategic finance function at corporates and is an increasingly popular next step for ex-bankers. Paul is a thought leader in the space who helps break down the FP&A role, the skills you need to be successful, and his thoughts on the future of financial modeling.

Episode 10 - Mastering Finance: Navigating CFA Institute and CFA Program Changes with Rob Langrick

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI) the most respected accreditations in Financial Modeling globally. In this episode, Paul Barnhurst is joined by Rob Langrick.

Rob Langrick, CFA, CIPM, is the General Manager of the CFA Program. He was previously Head of Practice Analysis, overseeing annual curriculum updates to the CFA Program.

Before joining CFA Institute, he lead Bloomberg’s finance education division, where he built and launched Bloomberg’s certification product. He began his career as a sell-side equity research analyst in London and, after earning his MBA from Dartmouth worked in the private equity diligence unit of Bain & Company in New York.

List to this episode as Rob Shares:

His learnings from the worst models he has seen in his career

His experience as an Equity Analyst

The CFA Program and why they modified the program to include new content

The value of FMI's financial modeling content to the new CFA Program

The importance of learning about Financial Models

His views on why financial models as one of if not the most important corporate decision making tool

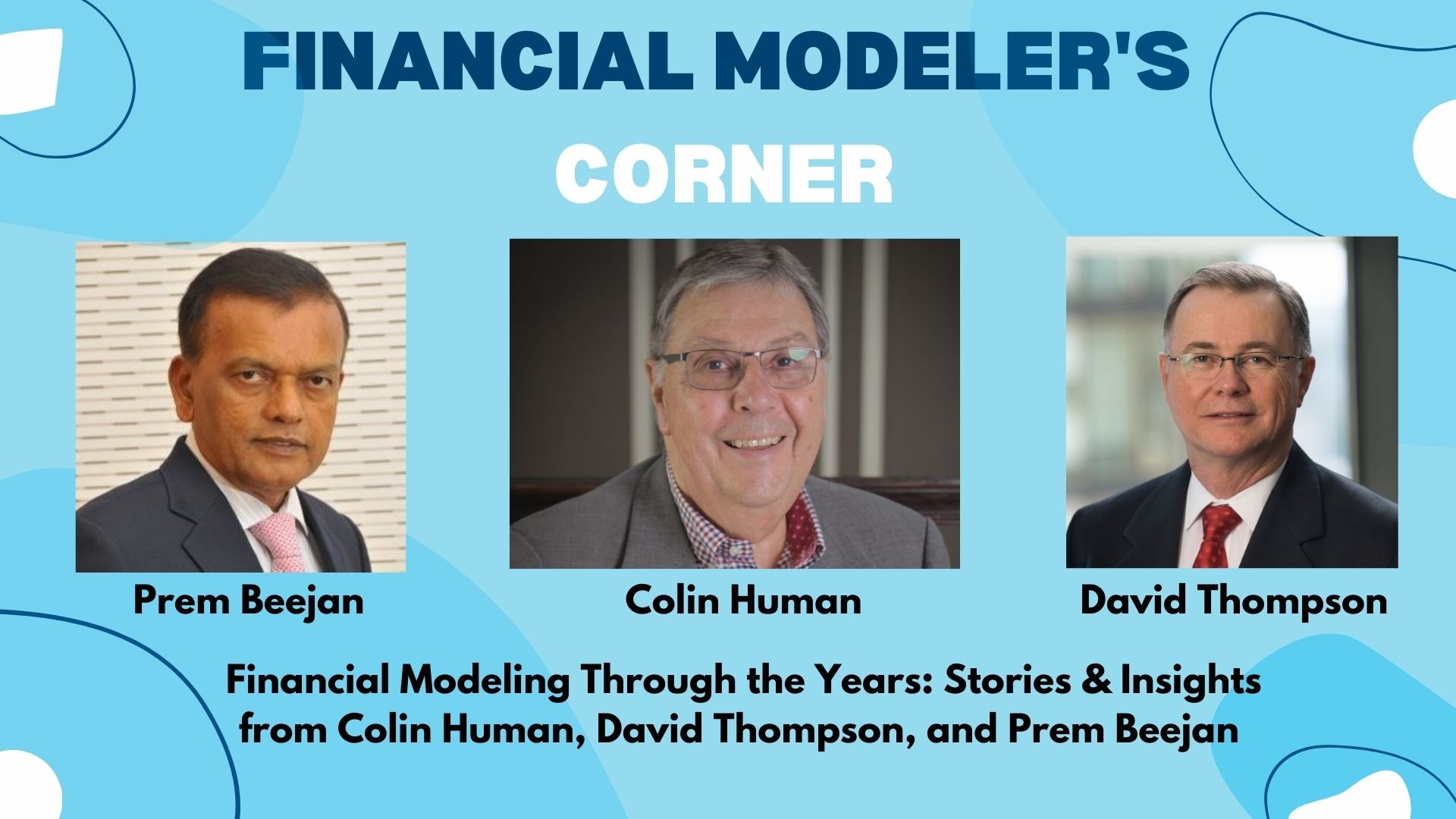

Episode 9 - Financial Modeling Through the Years: Stories & Insights from Colin Human, David Thompson, and Prem Beejan

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI) the most respected accreditations in Financial Modeling globally.

In this episode, Paul Barnhurst is joined by three distinguished modeling experts: Colin Human, David Thompson, and Prem Beejan.

Colin Human started out his financial career as a 22-year-old chartered accountant in South Africa. Today, he is the CEO of Goalfix and provides financial modeling consulting and training.

David Thompson is an independent financial consultant who provides expert financial modeling, financial planning & analysis, independent valuations, strategy, and corporate development services to both the public and private sectors.

Prem Beejan is the Chairman at Maubank Holdings LTD and the Co-founder of the Financial Modeling Centre in Mauritius. FMI recently awarded Prem the Master Financial Modeler, and he is one of only 6 people globally to be awarded the designation.

Listen to this episode as they share about:

How they got started in financial modeling

Their experience and learning from the worst models that they came across

Financial modeling over the years and how it has changed.

The various Modeling tools used by them

The impact of Generative AI on Models

The importance of Formal Accreditation

Their position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more

Episode 8 - Charting a Start-up’s Journey: Financial Models for start-up’s with Zainab Nwachuku

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI) the most respected accreditations in Financial Modeling globally.

In this episode, Paul Barnhurst is joined by Zainab Nwachuku, who is the Managing Director and the lead Financial Modeler of The Intellectual Plug which is a consulting firm in Nigeria that helps founders get ready for funding with investors.

Zainab is extremely passionate about financial modeling and hopes more women who are fond of numbers choose to join the profession.

Listen to this episode as Zainab shares:

Her journey from accounting to financial modeling

Her experience and learnings from the worst models she has come across

Her experience working with founders to help turn their ideas into a financial model that can help make their dreams a reality

The horror story of linking workbooks in Excel

Her unwavering passion for Modeling

Her position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more

In this episode, Paul shares some great modeling people and companies to follow to stay up to date on modeling.

Episode 7 - Are LAMBDAs & Dynamic Arrays the future of Financial Modeling? A lively discussion with 4 modeling experts.

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI), the most respected accreditations in Financial Modeling globally.

In this episode, your host, Paul Barnhurst is joined by 4 fabulous guests, namely, Jeff Robson, Danielle Stein Fairhurst, Craig Hatmaker & Ian Schnoor. They are all highly accomplished and respected modelers in the Financial Modeling profession. In this episode they share thoughts on Dynamic Arrays and LAMBDAs.

Jeff is a Financial Modeler, Business Analyst, International Trainer & Presenter. Danielle Stein is a Financial Modeler, Author, and Corporate Trainer based in Australia. Craig is a retired Financial Modeler and is a 5G (fifth generation) modeling enthusiast, and Ian Schnoor is the Executive Director at the Financial Modeling Institute (FMI), which is also the sponsor of this Podcast.

Listen to this episode as the guests talk about:

Why it is important to keep current on the latest developments in modeling

LAMBDAs what they are and how they could revolutionize financial modeling

Dynamic Arrays, what they are, how they work, and what it is like to build a model using Dynamic Arrays

How Dynamic Arrays will make auditing models easier

The guest's favorite Dynamic Array formulas

Episode 6 -Become a better Modeler by developing a decision-making mindset: Hedieh Kianyfard

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI) the most respected accreditations in Financial Modeling globally.

In this episode, Paul Barnhurst is joined by Hedieh Kianyfard, who is the founder of Finexmod. This is the website where Hedieh shares her views on financial modeling and shows that it’s possible to have fun with finance.

Hedieh is passionate about economic development and aims to make financial modeling easy and fun for everyone.

Listen to this episode as Hedieh shares:

Her journey and background in financial modeling

Her experience and learning from the worst models that she came across

How Hedieh considers Modeling as a great career and more than a stepping stone.

Responsibility as a modeler to reject bad projects and help ensure good projects are accepted.

Everything about her book- Financial Modeling Detective

10 Financial Modeling Commandments

Why people should avoid circular references – hint they are the devil 😊

The importance of having a decision-making mindset

Her position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more

Episode 5 - Becoming A Better Financial Modeler With Chris Reilly

In this episode, Paul Barnhurst is joined by Chris Reilly, who is the founder of Financial Modeling Education. Chris spent many years working in private equity and today, he runs his own business focused on providing financial modeling education and financial modeling consulting services.

Chris Reilly is very passionate about Financial Modeling and helping others learn to build robust financial models focused on the 3-financial statements.

Listen to this episode as Chris shares:

The worst model he ever built; hint it involves using his phone :)

His journey and background into Modeling

The importance of simple, uncomplicated model design

How being a part of a financial modeling community like FMI can help modelers

The revolver approach for managing cash and why it is important in modeling

The benefits and challenges of using EBITDA to value a company

His position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more

Episode 4: Financial Modeling education, Excel competitions, exciting academic research and more with Professor David C. Brown

In this episode, Paul Barnhurst is joined by David C. Brown, who is the Founder of Financial Modeling University Championships. He is an Associate Professor of Finance, and his teaching is focused on Financial Modeling, where he brings his real-world experience to the classroom with his students.

He is very passionate about research and the Wall Street Journal and MarketWatch have highlighted his work.

Listen to this episode as David shares:

His journey and background into Modeling

His experience starting and running the Microsoft Excel Collegiate Challenge

How Financial Modeling competitions help you grow and learn

The key differences between modeling for competition and modeling for work

His learning from his research and years of experience

How he would structure the college finance program if he were in charge

His latest research on Target Date Funds and how they perform relative to other retirement portfolios

His position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more

Episode 3 - Benefits of competing in the Financial Modeling World Cup- Insights from World Champion Diarmuid Early

In this episode, Paul Barnhurst is joined by Diarmuid Early, one of the best modelers in the world and, the Founder of Early Days Consulting. He is a regular competitor in the Financial Modeling World Cup (FMWC) and is often referred to as the Michael Jordan of financial modeling for his impressive results. He is the winner of the 2021 FMWC and a runner-up in the 2020 and 2022 editions.

Episode 2 - David Brown: The Future of Modeling

In this episode, Paul Barnhurst is joined by David Brown, the Managing Partner of D Brown Consulting and one of the most respected financial modelers, consultants, and educators in the field of finance with offices on multiple continents.

Listen to this episode as David shares:

His journey and background into ModelingHow to find your passion and be willing to put yourself out there

How he learned he had a passion for teaching at a young age

How intuition is a good place to start, but the model helps validate hunches and numbers

How he explains the balance sheet without using numbers to non-finance people

Ways to embrace AI and use it to be more efficient in the work you do.

His position on controversial modeling issues, including circular references, dynamic arrays, modeling standards, and more.

Episode 1 - Ian Schoor: Why Validate your Financial Modeling Skills?

Welcome to Financial Modeler's Corner (FMC) where we discuss the art and science of financial modeling with your host Paul Barnhurst. Financial Modeler's Corner is sponsored by Financial Modeling Institute (FMI) the most respected accreditations in Financial Modeling globally.

In this first episode, Paul Barnhurst is joined by Ian Schnoor, the Executive Director of the Financial Modeling Institute and one of the foremost educators on financial modeling globally.

Listen to this episode as Ian shares:

· What it was like in the early days of financial modeling

· Why FMI created a financial modeling accreditation in the first place

· The importance of Financial Modeling as a profession

· How FMI created a community to help all modelers find the best resources and elevate the profession in the process