The Role of Python and R in Financial Modeling Practices

In the finance world, staying ahead means constantly updating tools and techniques. As businesses face more complex data challenges, the need for advanced tools has grown. This is where integrating Python and R comes into play, enhancing your capabilities beyond traditional Excel significantly.

George Mount, a renowned Excel MVP and founder of Stringfest Analytics, specializes in this advanced integration. His work demonstrates how these programming languages can transform your analytical capabilities and improve your financial analysis.

In this article, we will explore how these languages,along with Excel, can offer financial professionals new levels of efficiency and effectiveness in their jobs.. We'll look at real-world applications and how easy financial experts can adopt these tools, enhancing their analytical capabilities.

Why Modern Financial Modeling Tools Are Essential Today

In this article, we will explore how modern financial modeling tools can transform businesses. We will look at the benefits these tools offer, such as better data integration, advanced risk modeling, and dynamic dashboards.

We will also discuss the challenges of adopting these tools and how to overcome them. With insights from Raphael Benhamou, we will learn how to leverage these tools for strategic growth and improved decision-making.

The Role of Standards and Simplicity in Professional Financial Modeling

In this article, we will explore Brian's insights on financial modeling. We will discuss his approach to simplifying complex models and the key differences between basic spreadsheet users and professional modelers. We will also share best practices for creating clear, concise, and easy-to-use models.

Let's uncover how professional financial modeling can transform data into actionable insights, helping businesses confidently manage their financial landscapes.

How to Leverage Dynamic Arrays in Excel for Better Financial Modeling

Nicholas Hay and Cameron Hay the co-founders of Finomatic Consulting are leading this advancement. Nicholas, with his background in languages and an MBA, and work experience in investment management.

Cameron, a trained chartered accountant who spent six years providing M&A and fundraising advice to technology companies, uses their deep expertise to enhance financial strategies for SAS companies.

In this article, we explore how dynamic arrays enhance Excel's capabilities based on insights from Nicholas and Cameron Hay. You'll learn how these tools can streamline your financial modeling processes and why embracing them could be a game-changer for your business.

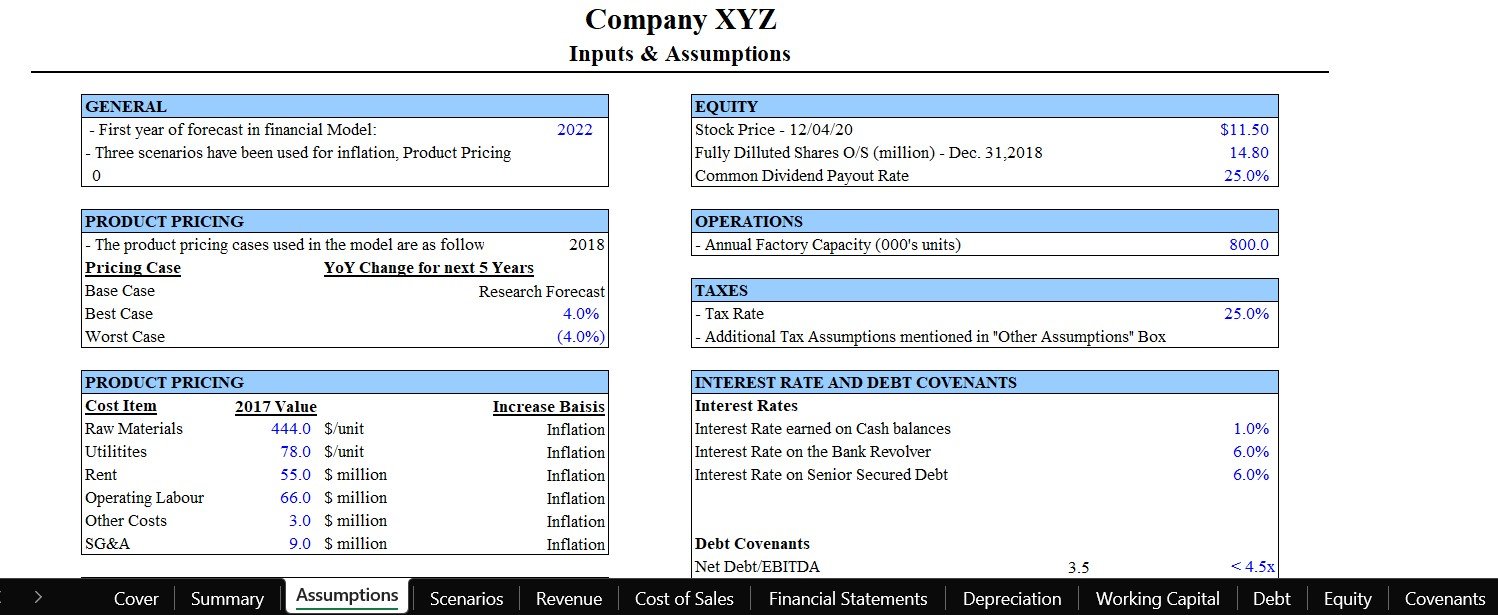

Proven Strategies for Creating An Effective Financial Model

Financial models are essential tools in today's business environment, guiding critical decisions and strategies. Creating an effective financial model requires precision and a clear understanding of financial principles.

Gary Knott, author of Avoid Excel Horror Stories began his career at Deloitte and later established his financial modeling consultancy, Knott Consulting. With a strong background in physics and mathematics, Gary's early work in accounting sparked his interest in financial modeling.

In this article, we will explore the structured practices that Gary recommends for building reliable and user-friendly financial models. We will learn from Gary's experience how to enhance model accuracy and functionality, ensuring their financial strategies are both sound and effective.

Aligning Industry Practices Through Financial Modeling Standards

Financial modeling is essential in today's business world, but the lack of standardized practices can create major issues. Stephen Aldridge, owner of Numeritas and financial modeling veteran, has worked at such prestigious firms as KPMG and Deloitte over the years. Stephen was involved in an effort to introduce Financial Modeling Standards for widespread industry adoption.

The initiative aimed to replace the varied and often conflicting methods currently used with a single, clear set of guidelines. This change will help everyone, from beginners to seasoned experts, build better models that are accurate and easier to understand.

In this article, we'll look at how Aldridge and a team of modeling experts from the top seven accounting firms collaborated to create these standards. We will explore their challenges, the solutions they found, and how these new standards can be used as a framework to help standardize and improve models.

Moreover, we will also see how establishing clear financial modeling standards can make a big difference, ensuring models are consistent and a true asset in strategic decision-making.

Keys to a Successful Mine-site Valuation

Keys to a Successful Mine-site Valuation

Exploration mines and acquisitions present significant opportunities for investors and businesses seeking to tap into mineral resources. However, acquiring these assets involves complex steps and considerations to minimize risks and ensure a profitable investment.

The article covers:

Introduction: Guide for investors in acquiring exploration mines.

Target Minerals: Focus on Silver & Gold due to strong market fundamentals.

Geological Assessment: Essential for estimating resources, costs, and planning.

Mining Methodology: Choose based on deposit characteristics, economics, and environmental considerations.

Market Analysis: Evaluate demand, pricing trends, and regulatory constraints.

Financial Model: Provides NPV and IRR calculations for profitability assessment.

Shripal Parekh, Founder @ Finaptive Solutions

Charlie X.W. Liu, Founder @ Monte Carlos Consulting Inc.

Optimal Financial Modeling Techniques for Better Business Forecasting

Financial modeling is an essential tool for understanding complex business dynamics. In a world where financial data grows more complex by the day, businesses need strategies that are not just effective but adaptable.

Carolina Lago, Managing Director at Tactic Financial, is at the forefront of this field. Her expertise in financial planning systems, like IBM Cognos Planning, has led to significant cost savings and efficiencies at multinational firms.

Carolina's background is impressive. She earned a Master of Accountancy focused on data analytics from Rider University and has become a specialist in FP&A and financial modeling. At Tactic Financial, she provides tailored financial strategies and top-tier corporate training, equipping companies with the skills to thrive financially.

How to Maintain Financial Modeling Integrity Amid Market Dynamics

In today's dynamic investment landscape, the ability to distill complex information into digestible insights is paramount. However, navigating the intricate world of financial modeling poses a significant challenge for many in the finance sector. These models are essential for informed investment decisions, but their complexity can sometimes conceal vital data.

Enter Geoff Robinson, a former UBS managing director turned financial educator, who advocates for the integration of educational principles in financial analysis. With a career spanning significant roles in equity research and financial education, Geoff has witnessed firsthand the complications that overly complex financial models can introduce.

How Simplicity in Financial Modeling Enhances Decision Making

In today's finance world, keeping things simple is not just a preference; it's a necessity. Yet, many professionals struggle with complex financial models. These models can make or break a business decision, but their complexity often obscures crucial insights.

Here, Scott Rostan, a former Merrill Lynch analyst turned educator who champions the power of simplicity in financial modeling. With years of experience, he has seen the pitfalls of overcomplication and now teaches the importance of clarity and industry knowledge.

How Tokenomics Redefines the Future of Finance

In the landscape of digital finance, the concept of Tokenomics emerges as a central pillar. This concept, crucial to cryptocurrencies and blockchain projects, shapes the future of finance.

This article aims to demystify the complexities of Tokenomics. Roderick McKinley is a seasoned financial modeler with a rich economics and blockchain technology background. His experiences highlight the nuances of creating economic systems that foster growth and sustainability within decentralized networks.

Shaping Business Strategy: Ian Bennett's Insights on What makes for a great financial modeler

The art and science of Strategic Financial Modeling have never been more crucial. As companies strive for growth, the role of financial models in forecasting, valuation, and scenario analysis cannot be overstated.

Ian Bennett, with over two decades of experience in Strategic Financial Modeling, sheds light on the intricacies and challenges within this critical domain.

Decoding Financial Modeling Complexities with Sam Sivarajan

In the dynamic world of finance, the art of financial Modeling stands as a cornerstone, pivotal in shaping business strategies and investment decisions. As markets evolve and technologies advance, the challenges and intricacies of financial Modeling grow, demanding more sophisticated and adaptable approaches. This article dives into these complexities, guided by insights from Sam Sivarajan, a seasoned expert with a rich law, investment banking, and behavioral science background.