Private Equity Finance Reporting (Actual, Proforma and Adjusted)

There are approximately, 16,000 private equity (“PE”) backed companies in the US which does include venture-capital backed companies which number over 36,000. According to a report issued by E&Y in 2021, private-equity backed companies make up about 6.5% of US GDP. These businesses are owned by around 14,000 private equity, hedge funds & investment vehicles (“Private Investment Vehicles”).

The above numbers are no doubt conservative for two reasons:

1. most Private Investment Vehicles are not required to report their holdings to external parties and

2. defining what exactly is a PE-owned company is mre debatable then definitive.

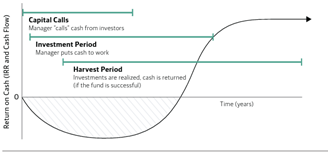

The Life Cycle of Private Equity

From The Life Cycle of Private Equity, by Blackstone. ..” capital will begin to be deployed by investing in opportunities selected by the [General Partner]GP in the first 3-5 years. The final 3-7 years, the harvest period, is generally when most investments are realized, and the fund, if successful, returns any cash to investors.”.

Stay in Finance long enough and you will have a high probability of working with, or in, a PE owned enterprise. When this happens, you will need to understand that the PE owners no longer look at the business as a vehicle for self-enrichment, in the short or medium term, but are laser focused on selling the company to another buyer for more than they paid for it in 5-10 years. There are always exception to this rule, but it is good practice to think that the new owners will be looking for some type of exit within that time frame,

How To Sell a Company For More Than You Paid For It?

To sell a business for more than it was purchased for, PE firms use 3 primary levers

Debt - Leverage the company with external debt and then use the cash flow of the business to pay down the debt. This would allow the owners to sell the business at the same price that it was purchased at, but still achieve a significant return

Increased transaction multiple - Generally, all businesses are traded on some type of multiple. Publicly traded companies value is often defined as its price-to-earnings (PE Ratio). A high PE Ratio indicates that the market is willing to pay more for future earnings compared to other companies in the same or similar industry. This same methodology applies to the PE world but instead of the PE ratio, earnings are defined as earnings before interest, taxes, depreciation and amortization, also called EBITDA. The price to metric multiple will frequently vary based on industry. For example, many professional service firms transact on a price to revenue basis. A PE owner can achieve a positive return if they can sell a business at a higher multiple then what they bought it at[1].

EBITDA expansion - Assuming the transaction multiple that the company was purchased on remains constant, increasing a companies EBITDA will lead to a higher investment return. This is typically the area that most PE firms focus their efforts on within the companies they buy.

Sample Private Equity Transaction

Under-Managed vs Managed

PE owners often look for companies that are under managed. What does “under-managed” mean? This generally refers to a situation where a company is not being effectively or efficiently managed to achieve its full potential. A company that is achieving its full potential will seek to take actions that maximize enterprise value. Many small and medium-sized businesses are managed to maximize cash flow and/or the owners benefit and not enterprise value.

Under management can manifest in a variety of ways, such as a lack of strategic direction or planning, poor financial management, ineffective leadership, low employee morale or productivity, or inadequate operational processes.

To combat under management, PE owners employ a cadence of reporting that seeks to hold senior management accountable to certain goals. The primary goal delegated to company management is EBITDA expansion. The Financial Planning & Analysis (FP&A) department is often the fulcrum of this new reporting structure. If resources are not available when the company is purchased then a CFO with FP&A experience or a head of FP&A is often brought on to help meet the new reporting requirements.

Frequently this new reporting structure is a huge cultural shift in how the company may have worked before requiring in-depth analysis on key topics related to revenue and cost.

Frequently this new reporting structure is a huge cultural shift in how the company may have worked before requiring in-depth analysis on key topics related to revenue and cost.

A shift to an investor mindset can often be difficult and confusing, but in doing so, can radically transform a company that will derive long-term value for not only its owners but also its employees and other stakeholders.

Financial Reporting To PE Owners

Because the focus of the PE owners is less on current earnings and more toward increasing total enterprise value, the way a company may have measured their performance historically may need to change. Monthly PE owner reporting can be categorized as Actual, Proforma and Adjusted.

Actual Reporting

Actual reporting is as it sounds, financial reporting in accordance with GAAP and/or as close to GAAP as possible. Many private companies manage their business on cash basis, meaning they record revenue when cash is received and expenses when paid. GAAP reporting requires the use of accruals and estimates to record revenue when earned and expenses when incurred, not necessarily when paid.

This alone may be a monumental change for many companies but is a very important shift that helps to change company culture away from short-term cash to longer-term enterprise value. If the company is already using accrual accounting, then you are ahead of the game and a focus on a smooth accounting close with a 2-3 workday flash, 10 workdays close (or less) and 15 workday reporting package creation targeted.

Proforma Reporting

Proforma reporting starts with actual reporting and then assumes that any acquisition or divesture occurred as of the beginning of the fiscal year. That may sound easy, but in practice it can be quite challenging. If the company was bought as a platform, in which other acquisitions are added, it will become increasingly difficult to identify the specific performance of each acquisition after purchase. This will be required to appease the PE owners that the investment in these new companies are financially worth it and meet the expectations upon which the acquisition was based.

It is imperative that transactions are tagged at the lowest possible level for each new acquisition or divesture in order to accurately report on this basis. Its not as simple as just adding or subtracting from actuals. Each lease, each employee, client, product and fixed asset needs to be pulled out from actuals. There is also a great reliance on the acquired company’s historical financials for the periods in which they were not owned. For example, if a new company was acquired on August 1st, you will need to add the 1st 7-months. (Jan – July) from the acquired company’s books onto yours to come up to year-end proforma numbers.

Senior management of most companies are held to some type of annual Budget, but the Budget would not include companies not yet acquired. Therefore, an acquired company’s performance for periods in which management did not control it, should not be taken into consideration when evaluating management performance. To account for this when doing variance analysis, the FP&A professional should set the acquired firm’s actual performance equal to budget for the historical periods in which it was not owned. This will allow for a Proforma presentation while still accurately presenting management performance. [KF4] [PB5]

Adjusted Reporting

Since PE owners are more focused upon steady state-run rate EBITDA, the effects of one-time items such as restructuring charges and/or investments in new technology, people or process are frequently added back to proforma EBITDA. The list of addbacks can be quite extensive and must be tracked at the transaction level and added back so they can be added back at the Income Statement line-item level.

Starting with Proforma reporting at the P&L level, one adds or subtracts (depending on if it is a revenue or expense) the addback to each P&L line item. This results in a P&L presentation with an EBITDA that closely represents what a run-rate EBITDA of the company would be at the time. The idea is that the adjusted EBITDA is what would be used to value the company at a point in times assuming a constant transaction multiple.

The above only applies to a company’s Income Statement. Its Balance Sheet is presented on an actual basis and so is the 13-week cash flow.

Why Do We Do All This?

Many a Finance professional has jumped through rings of fire to achieve the above, working long days and weekends to get to a package that is satisfactory to the PE owner and doable by company resources. So why is this all required? Do the PE owners make monthly decisions in which this information is based? The answer may surprise many of you, but primarily no they don’t. They consider this cadence a form of investment monitoring choosing to intervene “as needed” in management decision making.

A company that is acquired in a special situation transaction such as a bankruptcy or restructuring will often require much more direct decision making from the PE owner then one that is acquired in relatively good financial shape. The level of involvement by the PE firm is greatly dependent on their investment thesis and operating model.

The monthly financial reporting packages sent to the PE owners are typically accompanied with an hourly meeting to review the results. During these meeting the PE owners will ask questions of management, may challenge their results or request updates on various actions or plans. The monthly PE owners meeting is typically the beginning of a series of questions for the FP&A professionals within the company. At times it may seem futile to respond to all the questions thrown at you from a PE owner, but understand the investor mindset that the PE owner has. They need management at the company in order to see a return on their investment and frequently they are not in a position to take over or replace management in the short term, so they look to get as comfortable as possible with the financial performance of their portfolio companies to help them mitigate their risk and not necessarily maximize their return.

PE owner reporting, can be complex, difficult and frustrating at times. It is by far and away not easy, but understanding the PE owner’s perspective will help you provide a better reporting package to them and senior management for decision making, leading to increased EBITDA multiples and bigger exit for all involved.

[1] Transaction multiples are subject to market factors and are typically not significantly relied upon by PE owners to achieve their investment objective.