Exploring the Career Path from FP&A Professional to Fractional CFO

In today’s episode, we will explore the core skills and strategies that make an effective FP&A professional, the impact of new technologies on the field, and how these factors integrate into the role of a fractional CFO.

Drawing on Schultz's experiences, we'll discuss how embracing a broader understanding of finance helps professionals transition successfully. Moreover, we will learn the essential steps and challenges in moving from an FP&A professional to a fractional CFO, preparing them to navigate and succeed in this dynamic role.

What It Takes to Move from FP&A to CFO

In today’s episode, Paul sits down with Jon Laudie, to discuss integrating FP&A into strategic planning and decision-making across businesses.

With Jon Laudie, CFO at Zerorez. plunge into Financial Planning & Analysis (FP&A) and learn from Jon's rich experience and strategic insights. From his initial roles in investment banking to his current position as CFO, Jon shares valuable lessons.

How to Build and Maintain a Top-Performing FP&A Team

In business, managing finances with precision is crucial for success. This is where the role of an effective financial planning and analysis (FP&A) team comes into play. As businesses face new challenges and the economy shifts, having a sharp, well-integrated FP&A team is more important than ever.

In this article, Based on Richard Tame's insights, we will explore what makes an FP&A team exceptional and how these teams contribute to a company's strategic decisions and overall success. Richard Tame is the Chief Financial Officer at Coeus Institute and has extensive experience across industries such as airlines and tech startups.

How to Future-Proof Your FP&A Career

In today's business world, a career in Financial Planning and Analysis (FP&A) is more critical than ever. Nowadays, FP&A professionals need to do more than just crunch numbers; they need to think ahead and help guide their companies through the ups and downs.

In this article, based on insights from Carl, we'll look into what makes a successful FP&A career today. We'll cover everything from the essential technical skills to the soft skills that are just as important. We will learn why being good with numbers is just the start; communicating well and thinking strategically is also crucial. We'll also explore how technology is reshaping FP&A roles, making them more about strategic advice than ever before.

How FP&A and Product Management Work Together for Market Success

In this article, we will explore how shared vision, open communication, and a deep understanding of customer needs and product value drive success. We will dive into the importance of involving FP&A early in the product planning process to align on strategy and goals, enhancing product market fit and ensuring financial viability. By overcoming challenges such as budget constraints and data gaps, this collaboration not only fuels innovation but also aligns with organizational goals.

Experts like Dara Goroff, Urvi Kapadia, and Navya Rehani Gupta offer valuable insights into forging a successful partnership between FP&A and product management. Through their real-life experiences and expert advice, we will learn about all the challenges and strategies for fostering a successful partnership.

Taming the Budget Beast: Navigating Chaos with Preparation and Planning

How to improve your budgeting process. In this article we discuss the 4 Phases of planning and steps you can take within each phase to improve your budgeting process.

1- Phase 1 – Planning and Training

2- Phase 2 – Budget Preparation and Review

3- Phase 3 – Consolidation and Submission

4- Phase 4 – Approval and Budget Upload

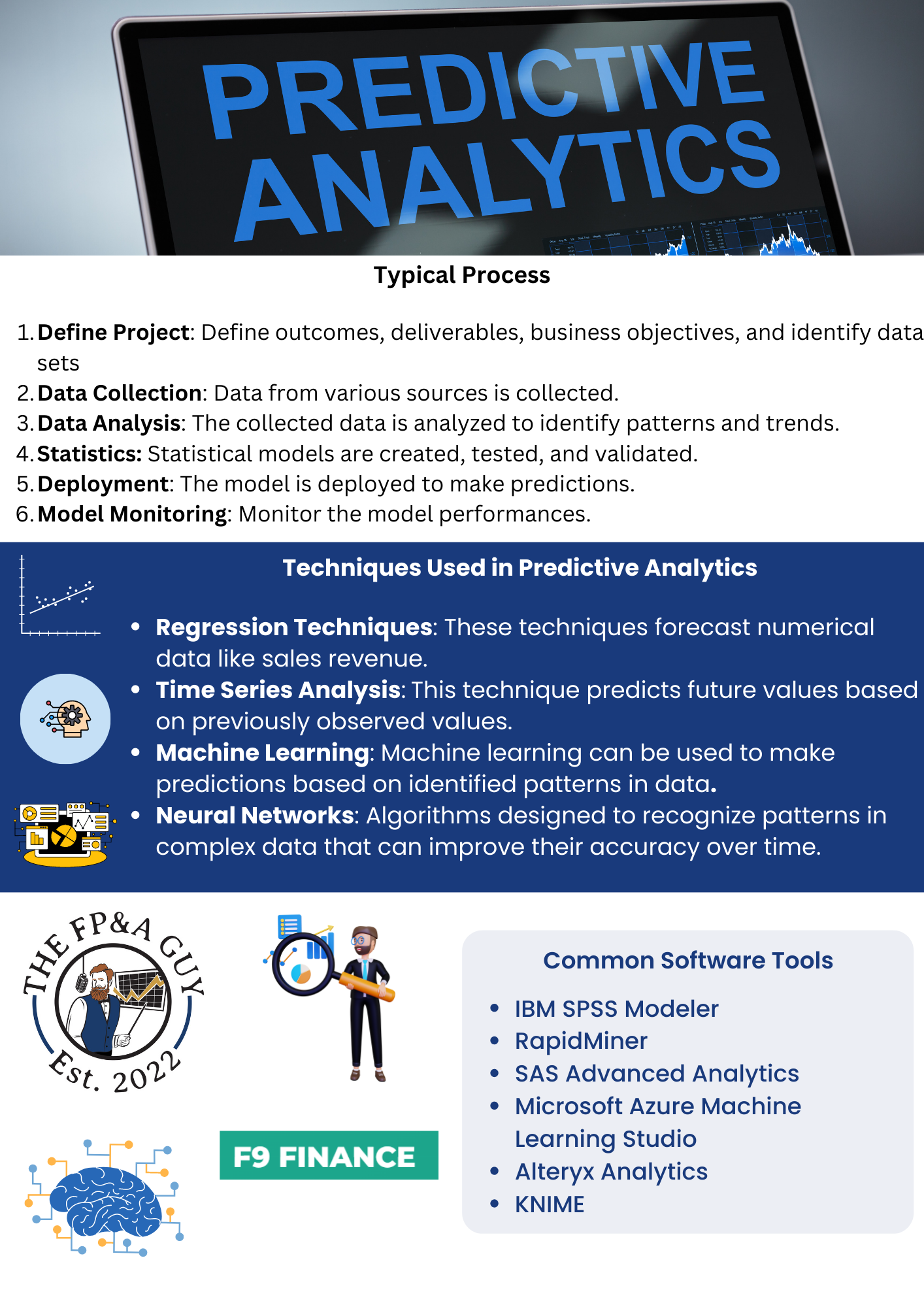

Using Predictive Analytics To Improve Forecast Accuracy

Are you looking for ways to improve your business forecasting?

Predictive analytics is a powerful tool to help businesses make more accurate forecasts. By using data-driven insights, predictive analytics provides valuable information about future trends and patterns in the market. This helps companies better understand their customers’ needs and plan ahead for potential changes in demand.

With predictive analytics, businesses can stay one step ahead of the competition by accurately predicting customer behavior and responding quickly to changes in the market. It also enables them to identify opportunities before they become apparent, allowing them to capitalize on new trends early on.

Learn more about how predictive analytics can help you improve your forecast accuracy today!

Duane Presti: The Passing of an FP&A Legend

The passing of Duane Presti

Duane Presti was indeed a visionary developer and business leader, taking into account users’ and companies’ needs in the ever-changing world of OLAP/relational databases, spreadsheets, business intelligence products, internet/Cloud and other technologies.

As one partner commented, “it was as though he was there from the Wright Brothers’ first flight all the way to the moon landing—a long way for a guy who graduated with an accounting degree to have traveled. And you know those accountants are mostly not the types to take such risks!”

Private Equity Finance Reporting: The Investment Thesis

Private Equity Finance Reporting:

• The investment thesis

• What is the investment thesis

• Why it is important if you work in Finance at a Private Equity (“PE”) owned company.

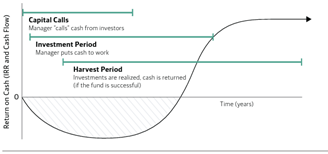

Private Equity Finance Reporting (Actual, Proforma and Adjusted)

Stay in Finance long enough and you will have a high probability of working with, or in, a PE owned enterprise. When this happens, you will need to understand that the PE owners no longer look at the business as a vehicle for self-enrichment, in the short or medium term, but are laser focused on selling the company to another buyer for more than they paid for it in 5-10 years. There are always exception to this rule, but it is good practice to think that the new owners will be looking for some type of exit within that time frame .

![Finance Controller KPIs that Every Professional Should Master [The Webinar + The Excel] (Copy)](https://images.squarespace-cdn.com/content/v1/624d94dd42c5f94c69531a7a/1673043446565-FMWEN8J4SRY3H7IV8KDP/scott-graham-OQMZwNd3ThU-unsplash+%281%29.jpg)

Finance Controller KPIs that Every Professional Should Master [The Webinar + The Excel] (Copy)

Key Performance Indicators (KPIs) for finance controllers are some of the most important metrics one can measure to determine company performance. Choose wisely, and get insight into what really makes your business soar. Choose not so wisely, and you’ll likely feel confused and lost, weighed down by metrics overload. That’s precisely why I chose to dive into this topic.

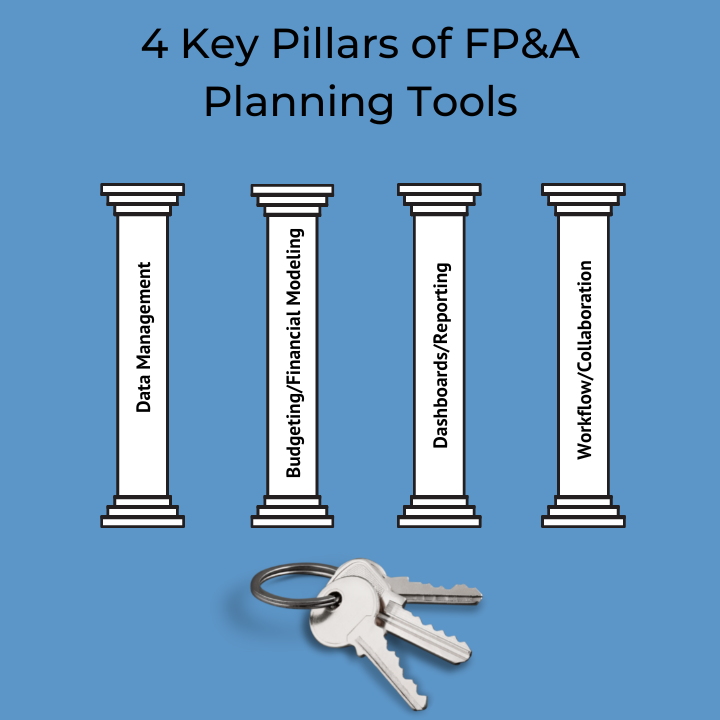

The 4 Key Pillars of FP&A Planning Tools

FP&A planning tools have 4 key pillars:

• Data Management

• Budgeting/Financial Modeling

• Dashboards/Reporting

• Workflow/Collaboration

In this blog post, we discuss the 4 pillars and what one should think about when looking to purchase a planning tool.

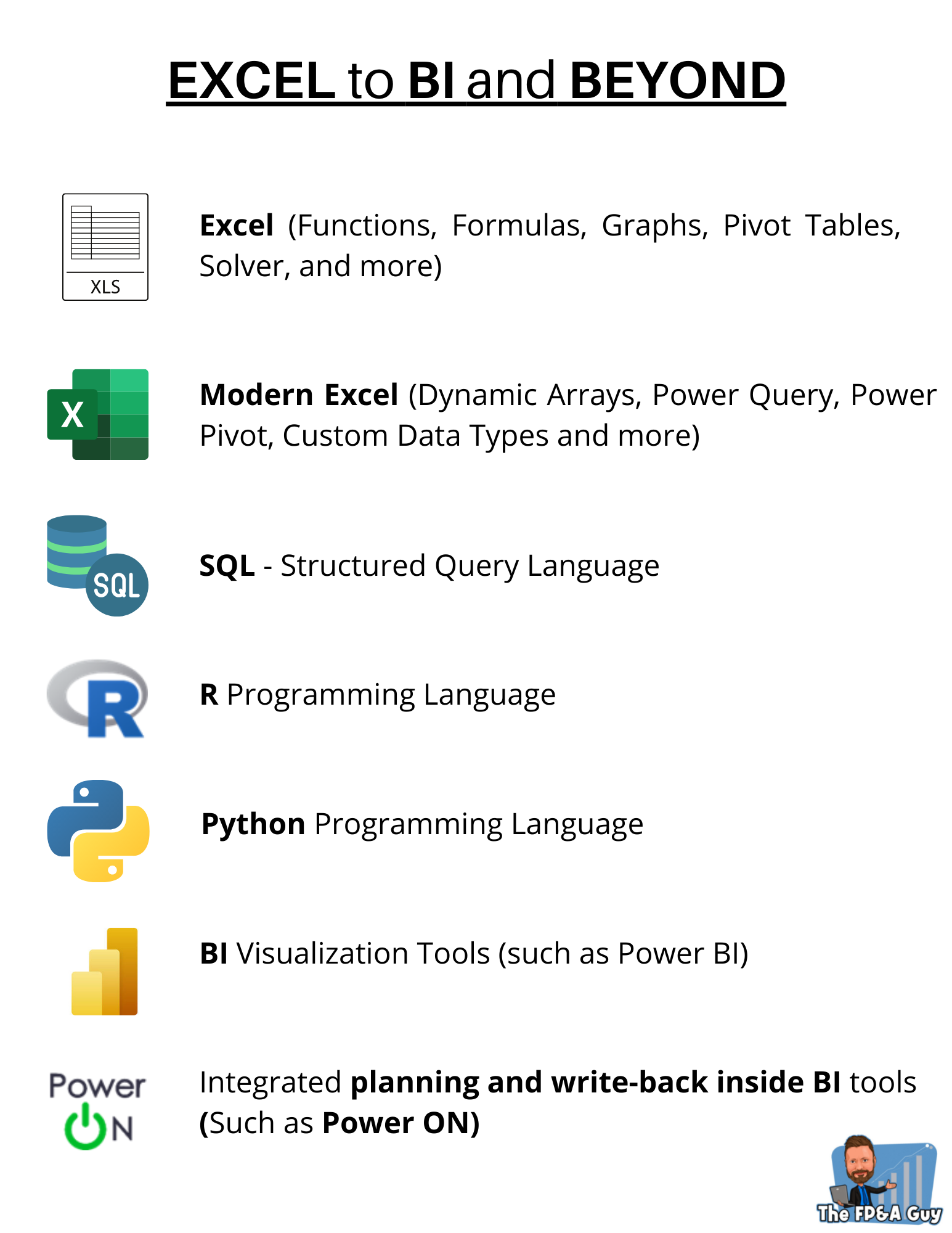

Why & How to Upskill your Data Analytics Skills

Why & How to Upskill your Data Analytics skills: From Excel to Power BI and Beyond!