Taming the Budget Beast: Navigating Chaos with Preparation and Planning

Written by Abudl Khaliq. If you are not following him on LinkedIn check out his content

Let’s face it: as much as the budget is critical in an organization's financial planning, it is an overwhelming and tiring process for everyone involved, especially the FP&A teams.

Throughout my career as part of the accounting team supporting FP&A teams or as someone driving the FP&A teams to deliver accurate and timely budgets, I have noticed that each year, the budgeting season begins with lots of enthusiasm, energy, and a solemn oath to keep the revisions to a minimum ‘This year we will not have more than three iterations,’ does that sound familiar?

However, we always end up with so many revisions we can hardly keep a count of them. That’s not my experience alone. I asked several FP&A leaders, ‘What’s the most challenging part of the budgeting process.’ Mostly, the answer was ‘Endless budget revisions’.

When I was transferred to manage the FP&A function, based on my previous years' experience with the company, I knew the revisions would be inevitable when the budget season came. At the beginning of the season, I asked one of my team members to write down why there was a budget revision each time.

Surprisingly, the results were not significantly different from our common understanding. But this time, we had written evidence of each incident when there was a revision.

These were the top five reasons:

Budget assumptions and guidelines were not explicit.

The budget process and timeline were misunderstood.

Shift in the market outlook.

Revised leadership directives and expectations.

Errors due to lack of thorough review.

Based on the insights we got from the revision tracker, we pinpointed the root causes that led to the revisions:

Lack of planning and organizing

Lack of clear communication.

Lack of overall understanding of the budget and the process.

Undecisive leadership decision-making.

Challenging market conditions.

As an FP&A team, we realized we had little control over leadership’s ever-changing expectations and no control over the market. However, by planning, we could significantly improve the first three.

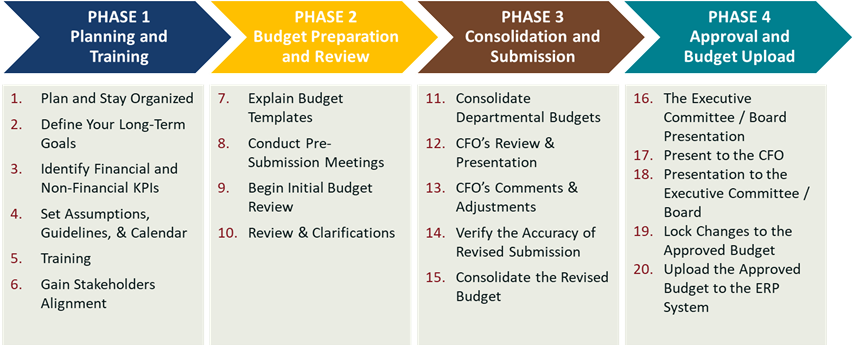

Well ahead of the next budget season, we developed step-by-step budgeting processes and mapped the challenges from the revision tracker. We divided the steps into four phases:

Phase 1 – Planning and Training

Phase 2 – Budget Preparation and Review

Phase 3 – Consolidation and Submission

Phase 4 – Approval and Budget Upload

Acknowledge the Challenges

Before diving into the budget process, it's important to recognize any obstacles that may come up. These obstacles could include long hours, making many changes, and ongoing adjustments. Recognizing these challenges is the first step in preparing for the process.

Let’s explore the 20-step process.

Phase 1 – Planning and Training

Step 1: Plan and Stay Organized

To tackle budgeting challenges effectively, meticulous planning and organization are critical. Break down the process into manageable steps, and create a detailed plan for each phase.

Step 2: Define Your Long-Term Goals

Begin the budgeting process by aligning your budget with the organization’s long-term goals, strategic objectives, and financial targets. Understanding where your company is headed will help you make informed financial decisions.

If your company prepares a periodic long-term strategic plan, align your budget assumptions and objectives with the long-term plan. This aligns the budgeting process with the organization’s overall strategy.

Step 3: Identify Financial and Non-Financial KPIs

Next, pinpoint the key performance indicators (KPIs) driving your business. These could include financial metrics like revenue and expenses and non-financial factors such as customer satisfaction and employee engagement.

Step 4: Set Assumptions, Guidelines, & Calendar

Establish clear assumptions, guidelines, and any specific instructions for budget preparation that will shape your budget. Create a timeline or calendar to keep the process on track and ensure everyone knows the deadlines.

Step 5: Training

Now that you have done your homework, you can identify the training needs of everyone involved in the budget process.

Are there any newcomers to the team? Not only in finance but across the board.

Is everyone thoroughly familiar with the budget process of the company? Which departments/individuals struggled the most in the last budget season?

Organize a session to align the expectations. Following the process outlined in Step 1 will enable you to deliver the session with maximum effectiveness.

Phase 2 – Budget Preparation and Review

Step 7: Explain Budget Templates

When I say templates, it means the medium your organization uses to prepare and consolidate budgets. You may have a consolidation tool or work on Excel templates. Either way, explain the budget templates to each department or team responsible for their budget. These templates should contain clear instructions and guidelines for filling them out accurately.

Step 8: Conduct Pre-Submission Meetings

Schedule regular pre-submission meetings with department heads to review their budgets. Address any initial concerns or questions to streamline the submission process.

Step 9: Begin Initial Budget Review

As budgets start coming in, initiate the initial budget review process. Ensure completeness and accuracy align with the organization's goals and guidelines.

Step 10: Review & Clarifications

Review budget submissions and seek clarification from department heads as needed. Make sure all figures are accurate and well-documented—request any potential changes that need to be made based on new information or evolving circumstances.

Tip: If you have worked with your CFO, you should clearly understand what they want to see during the initial budget review. Ensure you have answers to all those questions.

Phase 3 – Consolidation and Submission

Step 11: Consolidate Departmental Budgets

Combine all departmental budgets into a comprehensive organizational budget. Ensure that all inputs and changes are accurately incorporated.

Step 12: CFO’s Review & Presentation

Present the consolidated budget to the Chief Financial Officer (CFO) for their review. Provide a detailed budget overview, including key assumptions, financial projections, and any significant considerations.

Step 13: CFO’s Comments & Adjustments

Note any comments or adjustments the CFO directs during the budget review process. This may involve revisiting departmental budgets for refinements. Communicate those changes to the departments and ensure that they understand the ask and are aligned with the changes.

Step 14: Verify the Accuracy of Revised Submission

Double-check the accuracy of the revised budget submissions to ensure they accurately reflect the changes made during the review process.

Step 15: Consolidate the Revised Budget

Once revisions are complete, consolidate the revised budget to reflect the final version. Ensure that all changes are accurately reflected.

Phase 4 – Approval and Budget Upload

Step 16: The Executive Committee / Board Presentation

Prepare presentations summarizing the budget for approval by the Executive Committee or Board of Directors. Highlight critical aspects, financial implications, and strategic alignment.

Step 17: Present to the CFO

Present the final budget presentation to the CFO, providing a comprehensive overview and addressing any questions or concerns raised during the review process.

Step 18: Presentation to the Executive Committee / Board

Support the CFO in presenting the budget to the Executive Committee or Board of Directors. This step is critical in gaining the necessary support for the company budget. Ensure you have practiced your presentation and can answer any questions/concerns.

Seek their approval and address any queries or feedback they may have.

Step 19: Lock Changes to the Approved Budget

Lock down the budget to prevent unauthorized modifications. No further changes should be allowed to the approved budget.

Step 20: Upload the Approved Budget to the ERP System

Finally, upload the approved budget to your organization's Enterprise Resource Planning (ERP) system. Lock changes in the system to maintain budget integrity. This step ensures that everyone has access to the most up-to-date financial information.

Bonus Step: Reflect

Now that you have successfully got the budget approved, there is always room for improvement. Reflect! Reflecting on the strengths and weaknesses of the process will help you strategize for the next budget season. As a team, analyze what worked well and identify areas for improvement in the process. Document your findings and debrief all the stakeholders to set the winning strategy for the following year.

In conclusion, while budgeting can be complex, breaking it down into these logical phases and staying organized can make it more manageable. Following these steps can help you navigate the challenges and create a budget aligning with your organization's goals and financial strategy. Reflecting on your experience this year will help you improve the budgeting process for next year.